Capital Market

BSEC relaxes margin rules

April 19, 2023

· The Bangladesh Securities and Exchange Commission has relaxed margin loan rules.

· The stock market regulatory body issued a directive in this regard on Tuesday.

· The commission asked the country’ stock exchanges to consider companies which have remained under the ‘A’ category for three consecutive years, having paid-up capital of BDT 50 crore or more with price earnings ratio of more than 50 as marginable securities.

From: https://www.newagebd.net/article/199801/bsec-relaxes-margin-rules-for-good-performing-cos

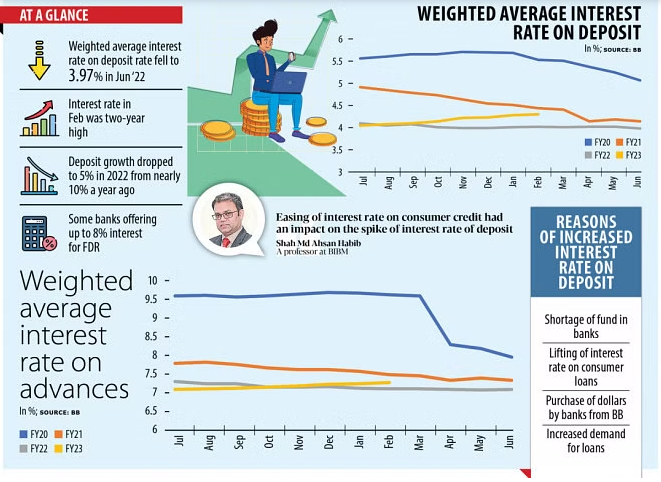

Good news for savers as banks hike deposit rate

https://www.thedailystar.net/business/economy/banks/news/good-news-savers-banks-hike-deposit-rate-3302251

Banking

Banks to run from 10am to 5pm after Eid holidays

April 19, 2023

· Banks will remain open from 10am to 5pm after the Eid holidays, the Bangladesh Bank (BB) said in a new directive.

· "There has been confusion among people regarding transaction hours after Eid. Therefore, in light of the governor's instructions, a clear message has been given regarding banking transactions hours after Eid.

· "Bank transactions can be performed from 10am to 3:30pm after Eid. However, banks will remain open from 10am to 5pm," Bangladesh Bank Executive Director Mejbaul Haque said.

From: https://www.tbsnews.net/economy/banking/banks-run-10am-5pm-after-eid-holidays-619230

Economy

Strain on forex reserves easing

April 18, 2023

· With increased export income and Eid remittances, the pressure on Bangladesh's foreign exchange (Forex) reserves is gradually reducing.

· Bangladesh's foreign exchange reserves have been hovering around USD 31 bn for the past few months, but the burden on Forex reserves may ease further in the coming months.

· Following the first installment of a USD 476.27 mn IMF loan, Bangladesh will get approximately USD 2 bn in budgetary support for the current fiscal year under a co-funding effort led by the Asian Development Bank (ADB) by next June.

· This fund, however, will arrive in Bangladesh in two phases. The first installment will include USD 1.05 bn in April and another USD 1 bn in June. ADB will contribute around USD 750 mn to this budget support project.

· This will assist in alleviating the increasing demand for foreign reserves.

From: https://www.dhakatribune.com/business/2023/04/18/strain-on-forex-reserves-easing

The need for cash before Eid raises call money rates

April 19, 2023

· The demand for cash withdrawal has surged before Eid raising the call money rate for interbank transactions.

· According to Bangladesh Bank website data, the average call money rate increased from 5.99% to 6.19% between April 2 and April 18.

· Data also shows that the lowest interest rate during this time ranged from 5% to 6%.

· The influx of money is also increasing. According to central bank sources, Bangladesh Bank has been supplying banks with an average of BDT 80 bn per day for the last month through repo, liquidity support facility, Islami Bank Liquidity Facility (IBLF), and Mudaraba Liquidity Facility (MLS).

· In the last seven days, the daily average figure of these instruments is up to around BDT 100 bn.

· An executive of commercial banks said the central bank is injecting a large amount of cash into banks daily.

Internet banking transactions growing fast

April 19, 2023

· The amount of money transactions through internet banking soared by 63.63% to BDT 2,199.60 bn in the July-February period in the financial year 2022-23 compared with that of BDT 1,344.25 bn in the same period of the previous financial year, as a growing number of people now prefer digital platform for executing banking activities.

· According to Bangladesh Bank data, the transaction amount through internet banking advanced by 247% to BDT 293.86 bn in February 2023 compared with that of BDT 84.77 bn in February 2021.

· The number of internet banking transactions rose to 5.7 mn in February 2023 against 2.28 mn in February 2021.

· In February 2022, the number of internet banking transactions was 4.5 mn worth BDT 177.63 bn.

· The usage of online platforms for banking activities has seen a significant increase among clients, particularly among the young people.

From: https://www.newagebd.net/article/199803/internet-banking-transactions-growing-fast

Cash outside banks drop further in Feb

April 20, 2023

· The amount of cash outside the country’s banks declined for the second consecutive month in February.

· According to Bangladesh Bank data, the volume of currency held outside banks dropped to BDT 2,576.67 bn in February, down from BDT 2,629.92 bn in January.

· BB officials said that some depositors who had withdrawn money before from banks out of fear were now bringing back their deposits.

· The decline came after the volume of currency outside banks hit an all-time high of BDT 2,680 bn in December, up from BDT 2,520 bn in November 2022 as depositors opted to hold more cash in their hands due to inflationary pressure and incidences of loan irregularities in the banking sector.

· The amount of cash outside the banking system was BDT 2,364.48 bn in June 2022.

From: https://www.newagebd.net/article/199907/cash-outside-banks-drop-further-in-feb

Huge container pile-up at Ctg port as importers delay goods release

April 19, 2023

· Pile-up containers are feared to disrupt Chattogram port operations during this Eid vacation when most local industries will remain closed. But the port will continue to run to keep the international supply chain functional, officials familiar with the matter said.

· The number of containers in the port yards reached 35,896 TEUs (twenty-foot equivalent units) on Wednesday, which was some 25,000 TEUs a month ago, according to the port authorities. If the container pile-up increases further during the five-day Eid vacation, it will be very tough for the port to operate, they added.

· To prevent such difficulties, the Chattogram Port Authority on 30 March wrote to trade bodies and stakeholders, including BGMEA and C&F agents, requesting them to get their goods released at the earliest.

· "We had expected that businesspeople will take prompt actions and get their goods released in a short time but it did not happen," a senior official at Chattogram Port, said.

· "Even the letter we issued to businesses did not get a good response," he added.

From: https://www.tbsnews.net/economy/huge-container-pile-ctg-port-importers-delay-goods-release-619570

MFS

bKash to invest BDT 870 mn in 2023 to improve services

April 18, 2023

· Bangladesh's largest mobile financial service provider bKash is committed to invest BDT 870 mn in 2023 in order to improve its services.

· The MFS company's commitment came in its financial report of the year ended on December 31 of 2022.

· It returned to a profit of BDT 172.1 mn in 2022 after incurring losses for consecutive three years, BDT 1,230 mn in 2021, BDT 670 mn in 2020 and BDT 630 mn in 2019, according to the financial reports of the company.

· "There are times when technology companies have to invest to improve products, services and technologies. They also need to spend on campaigns. We did the same. So, we incurred losses in those years," said Shamsuddin Haider Dalim, head of corporate communications of bKash.

· "Our investors knew that the investment would give them a return. Now, the return has started to flow in. So, its profit is now rising."

From: https://www.thedailystar.net/business/news/bkash-invest-tk-87-crore-2023-improve-services-3300126

note: these news are for research and analysis only